Thanks to the Governments $1000 kick-start payment, opting in to KiwiSaver was the easy part. A much harder decision is selecting the KiwiSaver scheme which is right for you.

As a nation we have successfully embraced KiwiSaver. It is important that New Zealanders ensure the assets they hold match their investment risk profile and time horizon. Unfortunately, this appears a more difficult decision than the initial opt-in or opt-out decision. As a consequence many NZs have not yet actively selected a KiwiSaver scheme to invest with and currently invest in a default KiwiSaver fund.

Over time, as public awareness (and KiwiSaver balances) grows, we expect more New Zealanders will consider their options carefully. The NZ Funds KiwiSaver Scheme, and in particular the LifeCycle portfolio management process, was designed to ensure New Zealanders hold the right mix of investments for their age and stage in life. Over any given decade such an approach is unlikely to produce outcomes at the top of performance tables, but neither should it produce outcomes at the bottom.

The NZ Funds KiwiSaver Scheme is designed to provide New Zealanders with the best of both worlds. From the outset members are exposed to three portfolios: Income, Inflation and Growth. This enables the member to be well diversified and to seamlessly reduce their exposure to growth assets as they get closer to retirement.

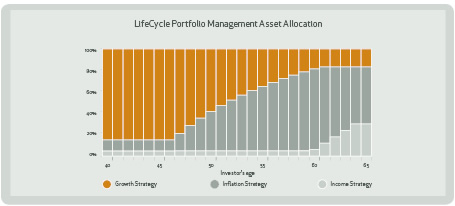

The LifeCycle option calculates the number of years that a member has until they reach the withdrawal age of 65 and customises their allocation to the Income, Inflation and Growth strategies accordingly.

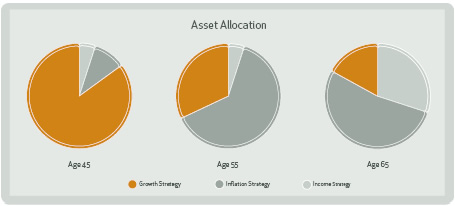

In this way, members below the age of 45 who have at least 20 more years to invest before the withdrawal date have a high exposure to growth assets. From age 46 onwards the members growth exposure is gradually reduced and their exposure to income and inflation strategies is increased in preparation for the withdrawal date.

LIFECYCLE PROCESS – AGE BASED ASSET ALLOCATION

LIFECYCLE PROCESS – POINT IN TIME ASSET ALLOCATION

While there are other KiwiSaver Schemes which offer reduced risk in the lead up to retirement, to date the NZ Funds KiwiSaver Scheme is the only scheme to annually revisit and reallocate each member’s asset allocation based on their age.

For further information on the NZ Funds KiwiSaver Scheme please contact us at whangarei@isnorthland.co.nz or free phone 0800 66 66 78.